TCM: Our Portfolio

Interact to learn more about our portfolio

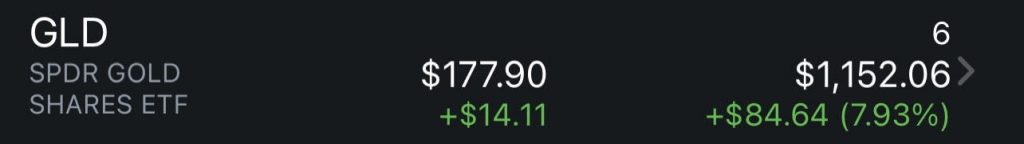

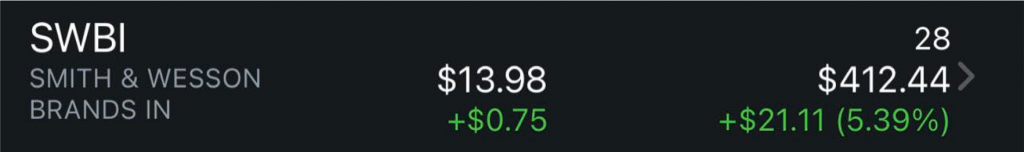

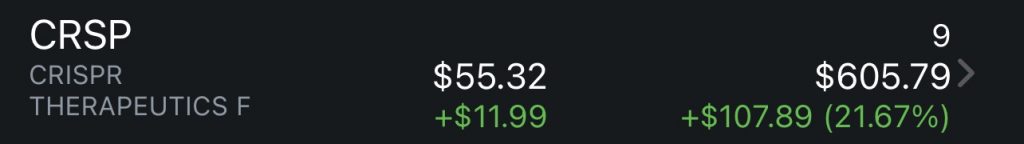

The Stock Market

Excel in the stock market.

Trading Cards

Did you know…

The first trading cards were printed in the 1860s by a sporting goods store? The first trading card was of Brooklyn Atlantics player Albert Spalding. Trading cards are a key piece in any sport. It allows spectators to have more commitment to their favorite players. The trading card market has grown in the last two decades in a way that many large investment firms are now categorizing the card industry as its own asset class.

As a long time collector, I have treated sports cards as a hobby and an investment vehicle. However, I have always maintained the mindset of buying cards that I believe the market is undervaluing whether or not I choose to keep or sell the card. The Card Merchant team will help you get the cards you want at the right prices, and also find investment opportunities outside of your personal collection to make a profit.

Wager Slips

Oh, sports betting!

Sports betting should be done for fun and should not be considered an investment. However, when profit is made from your investments in surplus and your risk tolerance has not been met, putting money on sports wagers and reinvesting the turnout can be a good strategy. However, know that with sports betting the most important thing to know is when to cash in your profits. The more wagers you place, the greater the probability of loss becomes.